Monday, December 31, 2012

It's Been A Good Year

Just calculated my return for 2012: 13.86%. Just a little bit better than S&P and worse than 15.9% of Nasdaq Composite. Well, the price you pay for little safety... I'm happy with the result anyway.

Happy New Year!

Well, I was wrong. We don't have rally, not yet. Well, today started just fine, but before that we had a week and a half of losses. @#$%^& politicians.

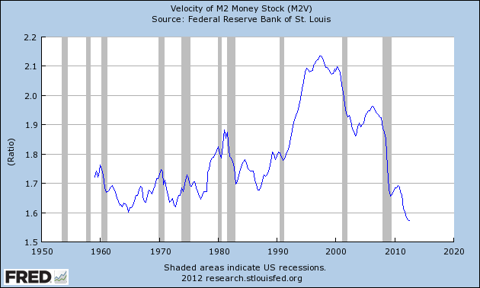

Never mind. I am optimistic for the next several months. And pessimistic for the whole 2013. Unless there is a big increase in government spending, economy is going down. Just look at this chart (taken fromhttp://research.stlouisfed.org/fred2/graph/?s%5B1%5D%5Bid%5D=M2V):

For those, who still remembers most the important equation MV = PQ and doesn't have any ideological blinders, it tells a lot. There is no real recovery in our economy so far. Velocity of money is still falling, it's at the lowest point since Fed started following it. If not for QE (1,2,3, infinity), we would have deflation right now. But QE is not enough. Fed is pushing on the string. Credit money has one big problem: it needs two parties. Somebody has to take the credit, even if it's given away for (almost) free. There is only one entity which can so it: federal government. You can complain all day long about government expansion, how it infringes on freedoms, how it changes structure of economy (always wrong way, according to libertarians), but this picture tells us more than a thousand words: without government intervention, this economy is going down. Hard.

I am going to enjoy coming rally and trim some of my positions in the first quarter. And probably move more investment to Europe and Japan. Politicians there look more flexible. And it's all about politics now.

Anyway, happy New Year to all my readers. Even with gloomy forecast, I wish you happy and profitable year.

Thursday, December 20, 2012

New Year And After

Reverse head and shoulders pattern worked beautifully. Market is up, as it should be in December. I feel good, but my thoughts are about future, as usual.

Fiscal Cliff is on our thoughts. I am actually very pessimistic about it. Yes, I'm sure it will be resolved. It will not be resolved soon, but it will be. But I don't believe in a good resolution

Obama is completely pissed off by 2011 debt limit crisis created by GOP from nothing. He doesn't show it, he behaves as a big politician (unlike most of GOP kids), but I can feel it. I understand this human emotion, but it won't lead to any resolution fast enough. Fresh from election victory, he will press for maximum.

GOP is full of themselves and don't understand the size of a hole they are in. They tried to start negotiations from position of force, which they don't have. Because if negotiations fail, Obama can always point a finger in their direction.

But the biggest problem is in any possible solution. Because only Bernanke and some Fed governors truly understand the size of the crisis. We are truly in Great Depression 2.0 (just read my blog from 2008-2009), and there is no easy exit. The only true cure is time. But struggling patient (economy) can't survive without some life support, which comes from two sides: Fed and Government. Fed provides unlimited credit when we are balancing on edge of disinflation if not outright deflation, when government spending helps to keep this credit in play. And any possible solution legislated by Congress and signed by President is going to cut government spending, instead of raising it.

I am as free market as it's only possible (not libertarian, because it's impossible, the only libertarian place on Earth is Somali). But desperate times call for desperate measures. Government already saved banks, AIG, GM and Chrysler. But it still didn't save the economy. We need more stimulus, not less, more spending, not less. There is also fundamental problem with increasing money supply by increasing credit. I'm afraid we are at some limit point here. If time permits and ideas fall together in my head, I'll write an article. about it.

Unfortunately, there is no political will for big government spending. That's exactly like Japan in 1990s. I don't think result is going to be different.

Back to the market. I feel that, regardless of Fiscal Cliff resolution, we are going to have a rally for next several months. Then reality is going to kick in: slow or no growth, unemployment rising again. Market is going to go down some, then range trading for years.

Best strategy I can imagine:

carefully choose growth stocks

add some fixed income

trade identifiable ranges.

Wednesday, December 5, 2012

See-Saw

Cody Willard is right. On two counts.

Fiscal cliff negotiations present a good trade opportunity. Buy on dips, sell on rips, leave some significant long positions. True, too many people think than we see a show in Washington and everything is going to be good in the end. As a contrarian play, it's worth it to buy some protection. I'm thinking about it.

Yes, Cody, Sandy was a black seagull. Not a black swan, too small for that. But I agree, there are too many people making Wall Street work who's been affected. And they had to pull some money out of market, because either insurance isn't paid immediately or it doesn't cover flood damage (and it doesn't, and even flood insurance doesn't cover much. Not in the area where houses worth half a million or more.

Several developments this week, in no particular order.

Nasdaq is trying to break 3000 and failing. Technically, it's bad. Past support is future resistance and future is now. If it breaks and holds, hoorah!

Dow components rally. Of course, Dow doesn't mean much lately, but worth noting.

Facebook (FB) is up. A lot. Over the level I bought my first portion. Way to go.

Munis are in fashion. Almost every muni CEF reduced payout all I hold did. Despite that, almost all of them are up. I will do some selling and readjusting before New Year, watch my StockTalk. I think many people are moving money from money market and CDs to the next safest (in common view) investment vehicle. Well, when the crown moves somewhere, time to think of getting out, eventually.

Corporate debt is not in fashion. That's probably where I'm going to move part of my money from munis.

Attention here! I don't give advice. I advise you not to follow my trades blindly. I do make mistakes and lose money. Yes, in the years I was successful, there is no guarantee that it was my brain and not just a blind luck. Even if it was brain, beware! Brains have a nasty habit to fade with time. So, do your own research and use your own brain. And beware the crowds.

Disclosure: I am long FB.

Additional disclosure: Positions can change any time

Fiscal cliff negotiations present a good trade opportunity. Buy on dips, sell on rips, leave some significant long positions. True, too many people think than we see a show in Washington and everything is going to be good in the end. As a contrarian play, it's worth it to buy some protection. I'm thinking about it.

Yes, Cody, Sandy was a black seagull. Not a black swan, too small for that. But I agree, there are too many people making Wall Street work who's been affected. And they had to pull some money out of market, because either insurance isn't paid immediately or it doesn't cover flood damage (and it doesn't, and even flood insurance doesn't cover much. Not in the area where houses worth half a million or more.

Several developments this week, in no particular order.

Nasdaq is trying to break 3000 and failing. Technically, it's bad. Past support is future resistance and future is now. If it breaks and holds, hoorah!

Dow components rally. Of course, Dow doesn't mean much lately, but worth noting.

Facebook (FB) is up. A lot. Over the level I bought my first portion. Way to go.

Munis are in fashion. Almost every muni CEF reduced payout all I hold did. Despite that, almost all of them are up. I will do some selling and readjusting before New Year, watch my StockTalk. I think many people are moving money from money market and CDs to the next safest (in common view) investment vehicle. Well, when the crown moves somewhere, time to think of getting out, eventually.

Corporate debt is not in fashion. That's probably where I'm going to move part of my money from munis.

Attention here! I don't give advice. I advise you not to follow my trades blindly. I do make mistakes and lose money. Yes, in the years I was successful, there is no guarantee that it was my brain and not just a blind luck. Even if it was brain, beware! Brains have a nasty habit to fade with time. So, do your own research and use your own brain. And beware the crowds.

Disclosure: I am long FB.

Additional disclosure: Positions can change any time

Wednesday, November 14, 2012

Amazing Days

Or maybe amusing days? I don't exactly understand what's happening. Fiscal cliff? This is a news more than a year old. Obama won? Come on, what idiots thought he wouldn't? When Intrade rated his win at 72% day before the election? What else? Europe? Nothing is happening there, really. Can't say it's good, but not that bad either.

It's not panic yet. I did some buying lately, mostly fixed income. If panic hits, I'm buying more. Fiscal cliff will be avoided, to some extent. Yes, some taxes will go up. And millionaires are not only ones going to get hit. But I don't expect 1+ trillion in tax hikes. And spending cuts aren't going to be that big either. Of course, I'd prefer that there is no tax hikes or spending cuts, and explosion of deficit, financed mostly by Fed. That would kick off some inflation, which we desperately need. But that's just me, there is no political will to it.

Long term, we are going Japanese. Low inflation, no inflation or even small deflation, low growth and flat stock market (and other markets probably) for decades. Which means that the only way to make some money would be on stock market, buying either high dividend or fast growing stocks. Another way of making money is to buy bonds. Forget about CDs, money market, government bonds (except munis). They are not going to pay any meaningful yield.

Wednesday, October 31, 2012

Increasing Fixed Income Share

If anybody is following my trades, they should've noticed that I'm buying more fixed income tools lately. There are some changes in my life, and I'm increasing share of fixed income in my portfolio. I don't have money to buy hundred grand lots of bonds, so the obvious choice is to buy closed-end funds.

I prefer muni bonds, but they are way too popular now, and prices are to high. I'm trying to buy high-yield muni funds on drops, and also some high quality corporate bond funds.

Buys in October:

Invesco Van Kampen Trust for Investment Grade Municipals (VGM)

Invesco Van Kampen Municipal Trust (VKQ)

First Trust High Income Long/Short Fund (FSD)

Nuveen Investment Quality Municipal Fund (NQM)

Helios Multi-Sector High Income Fund (HMH)

Additional disclosure: Positions can change any time.

Thursday, October 25, 2012

Tablets Are Coming

I didn't believe it. To me, tablet is a bad computer, no keyboard, no big storage, you can't see two applications on the screen at the same time. Unfortunately, as an IT professional, I made a big mistake. I thought that everybody is thinking like me. They are not.

Most people (even most IT professionals) use PC in one window mode. I have no idea how they manage it, especially when you need to look at two applications at once. But they do. Most people are not good with a keyboard (I can type with 10 digits, they don't). And most people don't care where they keep their data. Whether it a hard disk or cloud storage, doesn't matter. Data is there somewhere, that's it.

So, for the most people, tablet is a very good tool. Much smaller than a computer, much cheaper to maintain, much more reliable. Every Windows user I know had to completely reinstall OS every 2-3 years, or pay hundreds of dollars to somebody to do it, because of viruses and other malware. It's not a problem with tablets, not for now. Probably not for future either, because tablet OS, be it iOS or Android, based on much more reliable UNIX or Linux kernel.

Another plus of a tablet: it's portable. It weighs below 2 pounds, very thin, battery works for many hours. You won't find laptop computer as portable.

Until lately, I thought that tablets are not going to get into enterprise. Boy, was I wrong! They are popping everywhere! The most unexpected place? I went to the dealership to service my car. Half a year ago advisers still had PCs on their desks with some terminal software. Now they have Samsung Galaxy 10.1 tablets. With a keyboard and a stylus. And they don't look unhappy with this change!

Does it mean death of PCs? No, of course not. Mainframe computers are still around, so will be PCs. There are a lot of applications which need more resources and options than tablets can provide. PCs are going to be in the enterprise for a long time. But their share will be diminishing. PCs at home? Honestly, I don't know. They might hold on for a while. But eventually they are going to become a niche product.

OK, what does it mean for investing? Paradigm shift. PC related companies are dead. Dell (DELL), HP (HPQ) are black holes. The whole PC infrastructure is not investable. Forget about Microsoft (MSFT).

There is a big question about Intel (INTC). It's going to lose a lot of sales of low end chips, used in PCs. But it's also going to sell more server chips, because tablets require cloud infrastructure. And all talk about ARM CPUs in the server is remaining just talk, for now. I'm going to hold my position for a while.

Cloud related companies should be just fine. First of all, it's VmWare (VMW) and Red Hat (RHT), which create software used in cloud infrastructure. Google (GOOG) and Amazon (AMZN) will be fine too, they provide clouds. Of course, it's not the main source of income for either of these companies. As for tablet manufacturers, it's a big question. Apple (AAPL) is a winner on retail front, but it has a lot of moving parts and company is way too big now. Other tablet manufacturers, like Samsung, HTC and Acer, are not listed on US exchanges. ARM holding (ARMH) is a winner here, because every tablet (and every smartphone and almost every smart device) has ARM based CPU inside. I am not sure about other component manufacturers.

One remaining question is software. Who is going to be a leader here?

Additional disclosure: I have no positions in DELL, HPQ, MSFT, AAPL. Positions can change any time.

Wednesday, October 24, 2012

Still Going Down

I can't say anything good about this market. The direction is clear: down. Good news are ignored, bad news crush market.

Technicals are bad. Nasdaq Composite broke under 3000 yesterday and confirmed it today. And this is the only index that matters. Even S&P 500 is not that important, and Dow Jones doesn't matter at all.

Earnings season isn't that bad. Yes, several tech dinosaurs missed earnings. Who cares about IBM (IBM)? Or Microsoft (MSFT)? Even Intel (INTC) is not that important (and I still have long position in it, my bad). Google (GOOG) missed, but they are trying to turn company in the new direction now. They might succeed. But what a row of great earnings! ARM (ARMH), Facebook (FB), VMWare (VMW): that's new tech for you. Or such companies as DSW (DSW), Polaris (PII)? Never mind. Stocks are popping up after earnings report and then everybody forgets about them.

They say it's about elections. New idea on Wall Street is that Romney is bad for stocks. OK, why the $@&$ they spent many billions supporting him?

Doesn't matter. Nobody knows the future, I don't know what is going to happen in January. But for now, market direction is down.

Maybe I will buy some protection. Not sure. But most probably I will increase my position in successful stocks, like PII and FB.

Additional disclosure: I don't have any positions in IBM or MSFT. Positions can change any time.

Wednesday, October 10, 2012

I Don't Like This Tape

Head and shoulders pattern in Nasdaq Composite worked. Now we have another technical level: 3050. This support level is working since mid-August. But I don't think it's about technicals this time.

We had a good rally. Everybody hated it, so it worked. Now some people are liking it. Scary. Jim Cramer thinks that we are going to see a rally in "anointed" stocks into the year end. Maybe. But most obvious patterns usually don't work, just because everybody expects them.

What I don't like is the action. For the last three months, sell-offs have been stopped in the end of the day. This week it didn't happen. Earnings season started, nothing exceptionally bad is reported, market is still in red. That's very bearish.

Several things are widely commented on, and comments are all wrong, from my perch. Yes, QE3 started, and it wasn't expected. Well, we had a rally after that, but QE3 itself is not big enough to trigger a big rally. Yes, Europe is not going to fall apart any time soon. But they are not taking any decisive actions either. So there is no good catalyst for a rally right now.

We still might have a good rally in the year end. It might be triggered by election results (if Romney wins, somehow he is considered good for business, I've no idea why). It might be triggered by window dressing by funds, they missed most of the year's rally. In both cases I will be selling some of my positions. On the other hand, if current bearish action continues, I'll be tempted to by something. I prefer to buy low and sell high, not the other way around.

Monday, October 1, 2012

Back From Vacation

I am back. I really needed this vacation, couple of bad decisions right before it is a good illustration. It was idiotic to cover short position in Red Hat (RHT) calls. I was afraid of a big move after earnings report, but report happened after options expiration.

I almost ignored market when on vacation. Market ignored me as well, my overall portfolio hardly changed in the last two weeks. The only surprise: sharp (for the asset class) rise in the value of muni bonds and associated closed-end funds. Can't complain, I have sizeable position in them. But profits are made to be taken, so the first order of business today was to close position in Invesco Van Kampen Trust for Investment Grade Municipals (VGM). I am not fond of CEFs trading at a big premium.

It's hard to understand current market. Why Google (GOOG) is up more than 150 points (25%!) in two months? Maybe this position is in need of some trimming...

Among other things, there is a head and shoulders pattern in all major indices. It looks especially good (or bad, your choice) in Nasdaq Composite. If it works, index can go down to 3040. An obvious play is to buy $67 QQQ puts. I am not sure I'm doing it though. Risk / reward ration is not too good and I want to spend several days to get a feel of the market better.

Additional disclosure: I have no positions in VGM and QQQ. Positions can change any time.

Thursday, August 23, 2012

Mid-Year Portfolio Review

Portfolio goal. Growth. This is high beta, unapologetic growth portfolio with some safeguards and some boring investments. The goal remains unchanged.

Basic Principles. Most of the stocks in this portfolio were chosen for long term investment, which, for me, is about 18 months. Every stock is under review all the time, with a major review of the portfolio twice a year. I can trade around any position if I feel like it. The portfolio is not diversified by sectors. Diversification reduces risk, but it also reduces potential gain. No change in basic principles either.

Strategy. No strategy change since the beginning of year. I made changes, reducing cash and fixed income since January. I am planning no strategy changes until elections at least. Any changes will take into account fiscal cliff (or lack thereof) in 2013.

Paradigm Changers. These are stocks of companies that are changing business in sectors or even in the whole world.

Google (GOOG)

Ultimate disruptor. Google is changing the advertising world. The company is also aggressively moving to mobile internet advertising.

Risk: All great empires were destroyed by internal problems. There is also a risk of search ad market saturation.

I reduced position in the second quarter.

Plan: Hold, trade around.

Intuitive Surgical (ISRG)

Robotic surgery that is changing surgery of internal organs. Company has monopoly on robotic surgery right now.

Reduced position since last review.

Risk: new technologies are being developed, legislation changes can reduce demand.

Plan: hold.

VmWare (VMW)

Cloud computing is all the rage, and VmWare is on the front line. If a company wants to create its own cloud, VmWare is the way to go.

Traded around and in total added to position since last review.

Risk: it's not clear that internal clouds would win over external ones or over software as a service.

Plan: hold.

ARM Holding (ARMH)

Pure brain company. Company designs ARM CPUs for a wide range of mobile devices and licenses them to different companies. Most smartphones and all tablet computers I know run on ARM CPUs.

Traded around position since last review, resulting in net increase.

Risk: Tech world is changing quickly, somebody can invent a revolutionary new design and beat ARMH.

Plan: hold.

Red Hat (RHT)

New position. Company provides and supports Red Hat Linux, the most popular Linux distribution in enterprise world. Recently this OS became the most popular OS in clouds.

Risk: high valuation requires high growth. Any slowdown can crash the stock.

Plan: hold

Facebook (FB)

New position. The only social network company worth investing.

Risk: Wall Street hates the company.

Plan: hold, add on weakness.

DSW Inc (DSW)

New position. Yes, retailer can be a paradigm changer. Honestly, I wanted Zappos in its place, but instead of IPO company was sold to Amazon.

In any case, this is a great company and I like shopping there.

Risk: Any retailer is a high risk company. Anything can go wrong.

Plan: hold.

Qualcomm (QCOM)

New position. I bought it as a play on mobile network revolution. Now I'm having second thoughts.

Risk: there are not many hardware companies in mobile world. Loss of one customer can reduce sales and profits significantly.

Plan: watch.

Banks / Financials

Banco Santander (SAN)

Probably the best Spanish, and maybe European bank out there. High yield, big investments around the world. Bought it because I believe in resolution of Euro troubles. This is also can be placed in International part of the review.

Since last review I traded around position, resulting in net increase.

Risk: Currency fluctuations, more problems in Eurozone.

Steady growers / high yield. Companies with steady growth, high dividend or both. I am increasing weight of this group, such companies are best investments in depression times.

Polaris Industries Inc (PII)

One of the best recreation equipment manufacturers out there. Local (for me) company as well.

New position.

Risks: another recession, people don't like buying discretionary items in recessions.

3M Company (MMM)

Most innovative company in Dow Jones index. Another company headquartered in Minnesota.

New position.

Risk: another recession, management mistakes.

Intel (INTC)

Returning position. I was wrong to sell it in the first place High and growing dividend, growing company.

There is a lot of fear that decrease in PC production due to mobile computing will decrease consumption of Intel chips. But cloud computing requires a lot of Intel chips, and server chips have higher margin.

Plan: hold, add on weakness.

International

Indian Fund (IFN)

India is the only part of BRIC which I like now.

Added to position since last review.

Risk: political.

Plan: hold, add on weakness.

Fixed Income

I changed strategy in fixed income since last review. Now I have a group of closed-end funds, which are bought when at discount to net asset value or at low premium and sold at high premium. There are two groups of funds: corporate bond funds and muni funds. There are too many of them and they are rotating too fast to present them in the portfolio review. Watch my trades on stocktalk of Seeking Alpha.

Wednesday, August 22, 2012

Why People Make Idiotic Economic Forecasts? Because They Don't Invest

These two pieces about Niall Ferguson have been brought to my attention by Barry Ritholtz:

http://noahpinionblog.blogspot.com/2012/08/niall-british-empire-is-over-accept-it.html

http://www.businessinsider.com/niall-ferguson-has-been-wrong-on-economics-2012-8

Both show that Niall was completely, utterly wrong in his economic predictions. As far back as since 2004, if not much earlier. What can I say? Anybody can make forecasts in sport and economics not paying any penalty. In sport, it's an absolute truth. In economics, not so absolute. If you don't invest/manage your own money, you can say anything you want. But let's see what would happen if Niall followed his own advice:

2004: Niall thinks China is going to stop buying US debt. Logical conclusion: short Treasuries. Result: huge loss of capital.

2009: Niall predicts collapse of US Treasuries market. Logical conclusion: short Treasuries. Result: huge loss of capital.

2011: Niall predicts double-digit inflation for 2010s. Logical conclusion: short Treasuries, corporate bonds and stocks, buy gold. If anybody acted this way, s/he should be bankrupt by now.

My advice to Niall and anybody else making economic forecasts: put your money where your mouth is. And we'll see how it works.

Tuesday, August 21, 2012

About JP Morgan And MF Global

Just my opinion... There are a lot of publications crying for the prosecution of CEO and whoever else made decisions in these companies. I don't think so.

MF Global was an investment fund. As any investment company, it carried an implied risk. This risk was published in the fund business model: use leverage to buy short term government debt, mostly European and hold to maturity. What can go wrong if all governments (with small exception of Greece) paid all transhes in full and in time? Leverage. MF Global had to use debt securities as a collateral when taking loans. When those securities lost value because of another debt crisis, creditors required more collateral. It was classic margin call situation. Definitely, MF Global management made mistakes. Maybe somebody stepped outside the law, but only serious law enforcement investigation can prove it. So far it didn't. Investors lost money, but that's exactly the risk they accepted when investing in MF Global. I understand emotional aspect and lust for blood, but law is not about emotions. My advice to investors: research companies carefully.

JP Morgan (JPM) case is more complicated. The only reason they are not prosecuted now is repeal of Glass Steagall act. Banks, especially big, "too big to fail" banks, should not be allowed to trade like hedge funds. But they are allowed now and they are doing it. So, what JPM did was probably legal, but shouldn't be. Because if too big to fail bank fails, taxpayers will pay. You can shout, you can say "no more bailouts" but in real life, when there is a choice between a bailout of banksters and financial panic, any responsible government chooses bailout. That's why Glass Steagall act existed, that's why it should be restored in some form.

There is no evidence so far that JPM or some people there broke existing law. It means that nobody goes to jail, now. It also means that law must be changed. US (and, by extension, World) financial system should be protected from careless speculators.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Monday, August 13, 2012

Buying Back Fixed Income CEFs

Prices for fixed income closed-end funds are coming down. At last. Last month, I sold most of my positions in muni funds, leaving just small positions in BlackRock Long-Term Municipal Advantage Trust (BTA) and Invesco Van Kampen Trust for Investment Grade Municipals (VGM). Now prices came down a little bit and I'm establishing some positions.

Today I bought Helios Advantage Income Fund (HAV) and Invesco Quality Municipal Income Trust (IQI). Since the beginning of this year I was only buying muni funds, but at current yields, taxable fixed income funds make sense.

Prices probably will come down more. But now is the time to pick up funds if I want to get payouts in the end of the month.

Market action is interesting today. Most of the day all indices were down, but Nasdaq finished day in green. You can say that Google (GOOG) and Apple (AAPL) did that. Really, those two companies represent a big portion of Nasdaq. But for the last 4 years Nasdaq was a leading index, so for me this action is bullish.

Additional disclosure: I have no position in AAPL. Positions can change any time.

Thursday, August 9, 2012

This Is A Wrong Rally. Dom't Make Money From It!

If sentiment was the only indicator, I'd say that this rally has a long way to go. Everybody is telling you to be cautious. Careful out there! is the mantra. There are a lot of unknowns, fundamentals suck, Europe is going to crash etc. Oh well. My answer to it: never let your preconceptions to stay in the way of making money. This rally is making me money, because I'm long a lot of stocks. Yes, some of them under water. It always happen. You always make mistakes. The name of the game is to lose less money on losers than you are making on winners.

Unfortunately, sentiment is not the only indicator. Fortunately, technicals are great too. S&P is over 1380 level of resistance. Nasdaq is over 3000, again. Dow, who cares about Dow nowadays?

There is something to say about fundamentals. True, economy is slowing down. True, China is in trouble, and not only because of Europe. Europe is in crisis, US is barely growing, these are legitimate fundamental concerns. And so far I don't see which way chips will fall.

So, I really don't know when this rally is going to end. It looks different from June and July now. Then, we either had the beginning of the week down and rally on Friday or the week up and Friday drop. Now, it looks like overbought condition is getting worked out as a function of time. We'll see.

I am less bullish now than two weeks ago. But still bullish.

Tuesday, July 31, 2012

Slow Days

End of month. Traders are obviously waiting for:

Fed to say something

ECB to do something

August 1st to show market direction.

I think what's going to happen:

Fed will say nothing, at least nothing new.

ECB will say a lot and do nothing.

First days of August will show nothing.

Market indices are at the top of the current range. Some traders are waiting for a breakthrough. Some are taking profits on long positions. Fund managers are doing window dressing, trying not to be to obvious, not to draw SEC attention. That's why last two days were so slow.

I don't know what is going to happen next. August can start with a bang or not. One thing I know for sure: politicians (and central bank heads are politicians, whether they want it or not) don't want to make any decisions. Not now. Later, when vacations and Olympic games are over, maybe. So I could've expected slow grind (and trading in range) to continue in August, but for one thing. Hot money. I don't know where is it going next. And, unfortunately, hot money makes market now. Quite often with little help from media (when SEC and Justice are going to look at suspicious transactions coinciding with suspicious publications at last?)

I didn't do much this week. Sold calls against long positions in Red Hat (RHT) and ARM holding (ARMH) and bought puts on QQQ for insurance, that's it. Waiting for market direction.

Additional disclosure: I am short RHT, ARMH calls against long positions and long QQQ puts. Positions can change any time.

Saturday, July 21, 2012

Options Expiration

Today is options expiration. I had two positions:

short Facebook (FB) $25 puts, this one expired worthless, good

long WmWare (VMW) 97.5 calls, expired worthless as well, bad.

In total, they about cancel each other. Well, being flat is better than being at loss, but a little profit would be better.

Additional disclosure: Positions can change any time.

Thursday, July 19, 2012

Muni Closed-End Funds Portfolio Changes

My Mid-Year portfolio review is coming next week. I was thinking about doing it last week, but decided to wait for earnings.

Las couple of months I made changes in my Muni holdings.

Change number one: no more Nuveen closed-end funds. Looks like management sucks: funds are reducing payouts one after another. Today I sold Nuveen Select Quality Municipal Fund (NQS). Before that, I closed my biggest (for that moment) muni holding: Nuveen Municipal Market Opportunity Fund (NMO).

There are CEFs with better management. Currently I hold BlackRock Long-Term Municipal Advantage Trust (BTA), Invesco Van Kampen Trust for Investment Grade Municipals (VGM), Invesco Van Kampen Advantage Municipal Income Trust II (VKI).

Every position is a subject of trading around it. I did several trades around BTA. I also traded around Managed Duration Investment Grade Municipal Fund (MZF) and Dreyfus Strategic Municipal Bond Fund (DSM). Current strategy: buy at discount or small premium to net asset value and sell at premium above 4%. I know, DSM and MZF at times traded at 8% premium and I missed the profit. Well, that's life. You can't win everything. Anyway, every trade worked, with exception of NQS, where I'm about even, counting dividend.

Additional disclosure: I have no positions in other funds mentioned. Positions can change any time.

Subscribe to:

Comments (Atom)