Well, I was wrong. We don't have rally, not yet. Well, today started just fine, but before that we had a week and a half of losses. @#$%^& politicians.

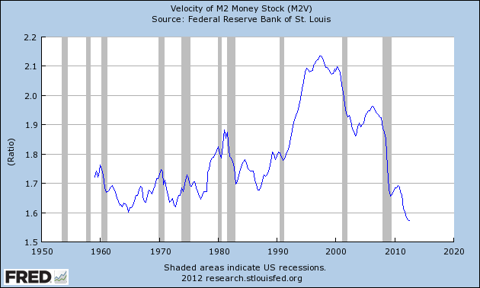

Never mind. I am optimistic for the next several months. And pessimistic for the whole 2013. Unless there is a big increase in government spending, economy is going down. Just look at this chart (taken fromhttp://research.stlouisfed.org/fred2/graph/?s%5B1%5D%5Bid%5D=M2V):

For those, who still remembers most the important equation MV = PQ and doesn't have any ideological blinders, it tells a lot. There is no real recovery in our economy so far. Velocity of money is still falling, it's at the lowest point since Fed started following it. If not for QE (1,2,3, infinity), we would have deflation right now. But QE is not enough. Fed is pushing on the string. Credit money has one big problem: it needs two parties. Somebody has to take the credit, even if it's given away for (almost) free. There is only one entity which can so it: federal government. You can complain all day long about government expansion, how it infringes on freedoms, how it changes structure of economy (always wrong way, according to libertarians), but this picture tells us more than a thousand words: without government intervention, this economy is going down. Hard.

I am going to enjoy coming rally and trim some of my positions in the first quarter. And probably move more investment to Europe and Japan. Politicians there look more flexible. And it's all about politics now.

Anyway, happy New Year to all my readers. Even with gloomy forecast, I wish you happy and profitable year.

No comments:

Post a Comment