Monday, December 31, 2012

It's Been A Good Year

Just calculated my return for 2012: 13.86%. Just a little bit better than S&P and worse than 15.9% of Nasdaq Composite. Well, the price you pay for little safety... I'm happy with the result anyway.

Happy New Year!

Well, I was wrong. We don't have rally, not yet. Well, today started just fine, but before that we had a week and a half of losses. @#$%^& politicians.

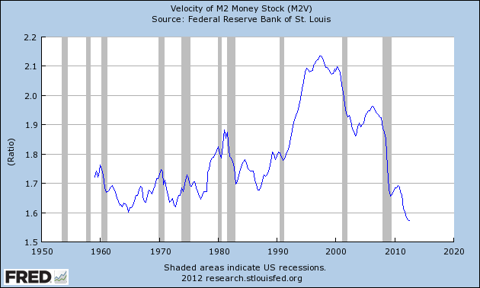

Never mind. I am optimistic for the next several months. And pessimistic for the whole 2013. Unless there is a big increase in government spending, economy is going down. Just look at this chart (taken fromhttp://research.stlouisfed.org/fred2/graph/?s%5B1%5D%5Bid%5D=M2V):

For those, who still remembers most the important equation MV = PQ and doesn't have any ideological blinders, it tells a lot. There is no real recovery in our economy so far. Velocity of money is still falling, it's at the lowest point since Fed started following it. If not for QE (1,2,3, infinity), we would have deflation right now. But QE is not enough. Fed is pushing on the string. Credit money has one big problem: it needs two parties. Somebody has to take the credit, even if it's given away for (almost) free. There is only one entity which can so it: federal government. You can complain all day long about government expansion, how it infringes on freedoms, how it changes structure of economy (always wrong way, according to libertarians), but this picture tells us more than a thousand words: without government intervention, this economy is going down. Hard.

I am going to enjoy coming rally and trim some of my positions in the first quarter. And probably move more investment to Europe and Japan. Politicians there look more flexible. And it's all about politics now.

Anyway, happy New Year to all my readers. Even with gloomy forecast, I wish you happy and profitable year.

Thursday, December 20, 2012

New Year And After

Reverse head and shoulders pattern worked beautifully. Market is up, as it should be in December. I feel good, but my thoughts are about future, as usual.

Fiscal Cliff is on our thoughts. I am actually very pessimistic about it. Yes, I'm sure it will be resolved. It will not be resolved soon, but it will be. But I don't believe in a good resolution

Obama is completely pissed off by 2011 debt limit crisis created by GOP from nothing. He doesn't show it, he behaves as a big politician (unlike most of GOP kids), but I can feel it. I understand this human emotion, but it won't lead to any resolution fast enough. Fresh from election victory, he will press for maximum.

GOP is full of themselves and don't understand the size of a hole they are in. They tried to start negotiations from position of force, which they don't have. Because if negotiations fail, Obama can always point a finger in their direction.

But the biggest problem is in any possible solution. Because only Bernanke and some Fed governors truly understand the size of the crisis. We are truly in Great Depression 2.0 (just read my blog from 2008-2009), and there is no easy exit. The only true cure is time. But struggling patient (economy) can't survive without some life support, which comes from two sides: Fed and Government. Fed provides unlimited credit when we are balancing on edge of disinflation if not outright deflation, when government spending helps to keep this credit in play. And any possible solution legislated by Congress and signed by President is going to cut government spending, instead of raising it.

I am as free market as it's only possible (not libertarian, because it's impossible, the only libertarian place on Earth is Somali). But desperate times call for desperate measures. Government already saved banks, AIG, GM and Chrysler. But it still didn't save the economy. We need more stimulus, not less, more spending, not less. There is also fundamental problem with increasing money supply by increasing credit. I'm afraid we are at some limit point here. If time permits and ideas fall together in my head, I'll write an article. about it.

Unfortunately, there is no political will for big government spending. That's exactly like Japan in 1990s. I don't think result is going to be different.

Back to the market. I feel that, regardless of Fiscal Cliff resolution, we are going to have a rally for next several months. Then reality is going to kick in: slow or no growth, unemployment rising again. Market is going to go down some, then range trading for years.

Best strategy I can imagine:

carefully choose growth stocks

add some fixed income

trade identifiable ranges.

Wednesday, December 5, 2012

See-Saw

Cody Willard is right. On two counts.

Fiscal cliff negotiations present a good trade opportunity. Buy on dips, sell on rips, leave some significant long positions. True, too many people think than we see a show in Washington and everything is going to be good in the end. As a contrarian play, it's worth it to buy some protection. I'm thinking about it.

Yes, Cody, Sandy was a black seagull. Not a black swan, too small for that. But I agree, there are too many people making Wall Street work who's been affected. And they had to pull some money out of market, because either insurance isn't paid immediately or it doesn't cover flood damage (and it doesn't, and even flood insurance doesn't cover much. Not in the area where houses worth half a million or more.

Several developments this week, in no particular order.

Nasdaq is trying to break 3000 and failing. Technically, it's bad. Past support is future resistance and future is now. If it breaks and holds, hoorah!

Dow components rally. Of course, Dow doesn't mean much lately, but worth noting.

Facebook (FB) is up. A lot. Over the level I bought my first portion. Way to go.

Munis are in fashion. Almost every muni CEF reduced payout all I hold did. Despite that, almost all of them are up. I will do some selling and readjusting before New Year, watch my StockTalk. I think many people are moving money from money market and CDs to the next safest (in common view) investment vehicle. Well, when the crown moves somewhere, time to think of getting out, eventually.

Corporate debt is not in fashion. That's probably where I'm going to move part of my money from munis.

Attention here! I don't give advice. I advise you not to follow my trades blindly. I do make mistakes and lose money. Yes, in the years I was successful, there is no guarantee that it was my brain and not just a blind luck. Even if it was brain, beware! Brains have a nasty habit to fade with time. So, do your own research and use your own brain. And beware the crowds.

Disclosure: I am long FB.

Additional disclosure: Positions can change any time

Fiscal cliff negotiations present a good trade opportunity. Buy on dips, sell on rips, leave some significant long positions. True, too many people think than we see a show in Washington and everything is going to be good in the end. As a contrarian play, it's worth it to buy some protection. I'm thinking about it.

Yes, Cody, Sandy was a black seagull. Not a black swan, too small for that. But I agree, there are too many people making Wall Street work who's been affected. And they had to pull some money out of market, because either insurance isn't paid immediately or it doesn't cover flood damage (and it doesn't, and even flood insurance doesn't cover much. Not in the area where houses worth half a million or more.

Several developments this week, in no particular order.

Nasdaq is trying to break 3000 and failing. Technically, it's bad. Past support is future resistance and future is now. If it breaks and holds, hoorah!

Dow components rally. Of course, Dow doesn't mean much lately, but worth noting.

Facebook (FB) is up. A lot. Over the level I bought my first portion. Way to go.

Munis are in fashion. Almost every muni CEF reduced payout all I hold did. Despite that, almost all of them are up. I will do some selling and readjusting before New Year, watch my StockTalk. I think many people are moving money from money market and CDs to the next safest (in common view) investment vehicle. Well, when the crown moves somewhere, time to think of getting out, eventually.

Corporate debt is not in fashion. That's probably where I'm going to move part of my money from munis.

Attention here! I don't give advice. I advise you not to follow my trades blindly. I do make mistakes and lose money. Yes, in the years I was successful, there is no guarantee that it was my brain and not just a blind luck. Even if it was brain, beware! Brains have a nasty habit to fade with time. So, do your own research and use your own brain. And beware the crowds.

Disclosure: I am long FB.

Additional disclosure: Positions can change any time

Subscribe to:

Comments (Atom)